Eligible for a health savings account through your employer? You're in luck.

An HSA, or health savings account, has serious financial benefits. The money you contribute is tax-deductible, and the money you make from interest or investments is tax-free. This adds up to huge savings over time.

Instead of letting your contribution sit idle for years, take these steps to maximize each dollar you put into your account.

Select your contribution (families can contribute up to $6,750).*

The first thing you’ll want to do is estimate your family's medical spend for next year. Is a member of your family expecting to have surgery? Are you adding a child to your family? If so, consider contributing your maximum amount.

Other reasons to contribute the maximum? If you or your spouse is approaching retirement, or if you want to maximize the amount of money that's growing tax-free.

$6,750 a year is around $562.50 dollars a month. Think about your income level and risk tolerance, and decide whether contributing this amount makes sense for you. You may want to start by contributing fewer dollars and slowly increase your amount over the year. You’ll see the benefits from any amount you decide to contribute.

Shop for qualified medical expenses

Another perk of an HSA is that you can use your HSA dollars to shop for qualified medical and health-related items. The dollars you spend on these approved items are not taxed. (Note: You should not use your HSA dollars to buy non-approved items. If you do, you will be subject to taxation and penalties.)

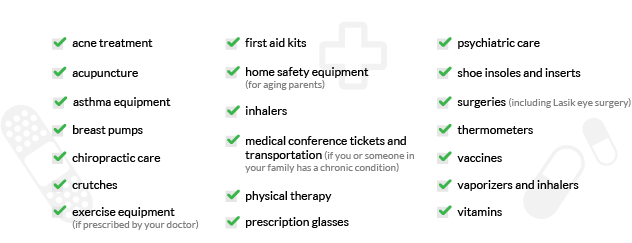

Here are a few common family medical items that are covered.

Invest in your family’s future

Interested in growing the money you contribute each year? Investing your health savings account dollars in mutual funds is a safe way to build your savings. Investment returns are tax-free!

Depending on your account, you may need a minimum amount of money contributed in order to invest. Are you a higher-income family? You may consider using non-HSA dollars to buy medical expenses. That way you can contribute more dollars to your mutual fund investment.

Walk through our suggestions with your family's expected medical expenses, income, and risk tolerance in mind. We hope these steps will help you maximize your health savings account dollars in a way that works best for your family.

*Maximum contributions are determined by the Internal Revenue Service (IRS) each year. $6,750 is the maximum amount for a family in 2017.